Life Insurance in and around Cincinnati

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

Protect Those You Love Most

People purchase life insurance for individual reasons, but the main purpose is many times the same: to protect the financial future for your partner after you're gone.

Insurance that helps life's moments move on

Life happens. Don't wait.

Their Future Is Safe With State Farm

When selecting what type of policy is appropriate, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like the age you are now, your health status, and perhaps even gender and occupation. With State Farm agent Shelonda Payton, you can be sure to get personalized service depending on your individual situation and needs.

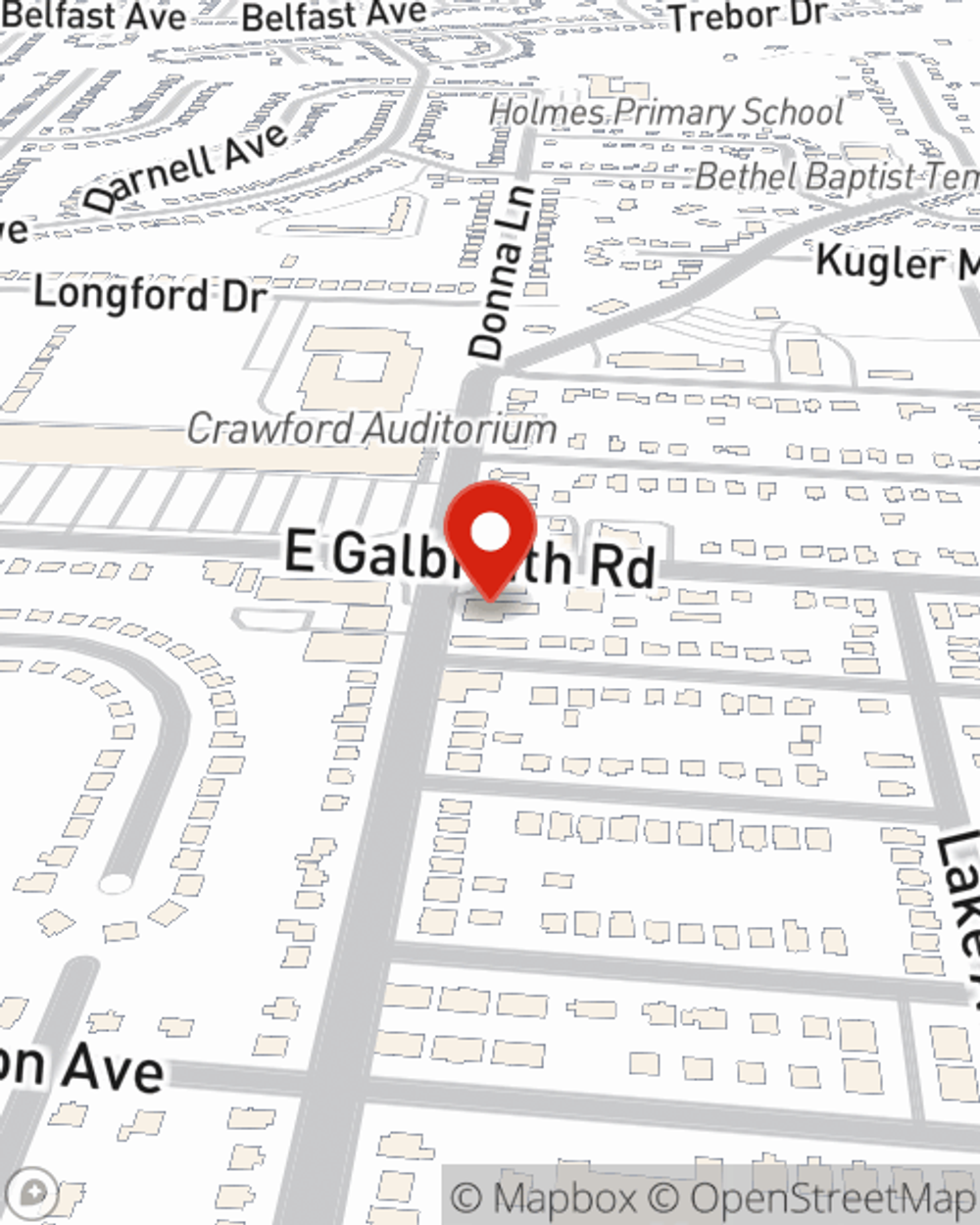

To discover your Life insurance options with State Farm, contact Shelonda Payton's office today!

Have More Questions About Life Insurance?

Call Shelonda at (513) 793-4311 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Shelonda Payton

State Farm® Insurance AgentSimple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.